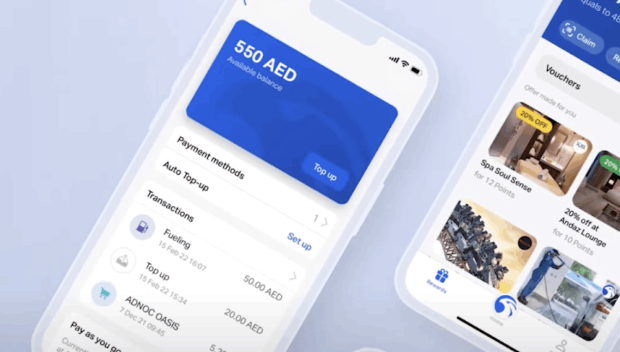

- Consumer

-

Business

- Fuel

-

Lubricants

Lubricants

ADNOC Distribution produces and blends top-grade lubricants at our state-of-the-art facilities in Abu Dhabi to the highest international standards from world-renowned murban crude oil. We offer a wide range of premium products across automotive, industrial, marine and speciality.

Contact us

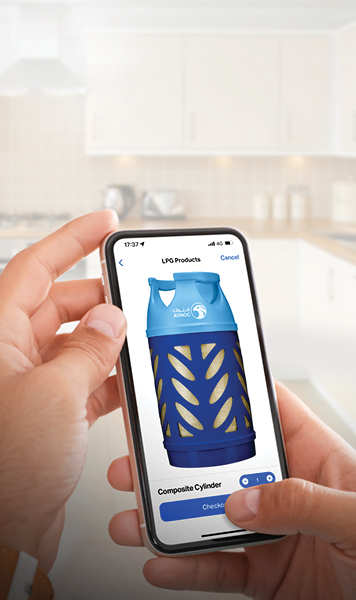

- LPG

- Delivery Services

-

Corporate

- Our Story

- Our Business

- News & Media

-

Sustainability

Sustainability

Sustainability

-

Investor Relations

- Overview

-

Results & Presentations

-

Shareholder Information

-

Sustainability

Sustainability

Sustainability

- News

- Ask ARIF

- Contact Us

- Login